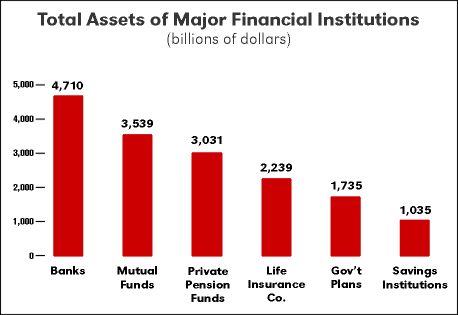

At the end of 1996, the nation’s 6,293 mutual funds had combined assets of $3.539 trillion. Mutual funds were second to commercial banks in asset size. At the end of the fourth quarter of 1996, the latest period for which figures are available from the Federal Reserve Board, the assets of commercial banks totaled $4.710 trillion.

Assets of other major financial institutions in the same period include private pension funds at $3.031 trillion; life insurance companies, $2.239 trillion; state and local government pension plans, $1.735 trillion; and savings institutions at $1.035 trillion.

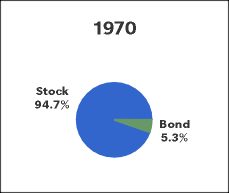

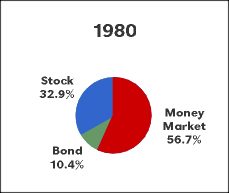

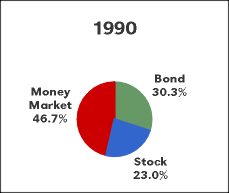

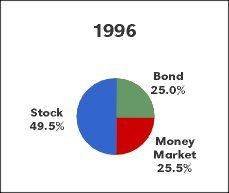

Composition of Fund Assets: Of combined assets of $3.539 trillion at December 31, 1996, stock funds accounted for $1.751 trillion, bond and income funds posted assets of $886.47 billion, and money market funds held $901.81 billion. Stock funds at the end of 1996 held 50% of mutual fund assets, compared with 23% at the end of 1990 and 33% in 1980. Bond and income funds comprised 25% of fund assets, compared with 30% in 1990 and 10.4% in 1980. In the early 1970’s, before money market funds were created, stock funds accounted for the vast majority of the industry’s total assets. The long-term growth of mutual fund assets is a result of appreciation and net new cash flow. From the beginning of 1984 to the end of 1996, 46% of the industry’s asset growth came from appreciation. Net new cash flow contributed 54% to the growth in assets.

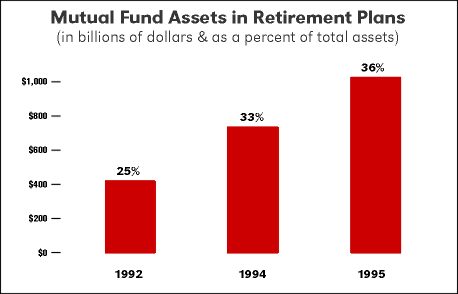

The Role of Retirement Savings: Mutual funds are the investment vehicle of choice for many retirement plans and, consequently, the retirement market plays an increasingly important role in the fund industry’s growth. At year-end 1995, the latest figures available, an estimated 35.7% of mutual fund assets, or $1.006 trillion, was held by retirement plans, compared with 33%, or $716.4 billion, in 1994; and 25%, or $411.8 billion, at the end of 1992.